Streamline your lending operations and drive growth with Mortgage Automator - a powerful loan origination and servicing...

Software Advice offers objective, independent research and verified user reviews. We may earn a referral fee when you visit a vendor through our links.

Learn more

Our commitment

Independent research methodology

Software Advice’s researchers use a mix of verified reviews, independent research and objective methodologies to bring you selection and ranking information you can trust. While we may earn a referral fee when you visit a provider through our links or speak to an advisor, this has no influence on our research or methodology.

How Software Advice verifies reviews

Software Advice carefully verified over 2.5 million+ reviews to bring you authentic software and services experiences from real users. Our human moderators verify that reviewers are real people and that reviews are authentic. They use leading tech to analyze text quality and to detect plagiarism and generative AI.

How Software Advice ensures transparency

Software Advice lists all providers across its website—not just those that pay us—so that users can make informed purchase decisions. Software Advice is free for users. Software and service providers pay us for sponsored profiles to receive web traffic and sales opportunities. Sponsored profiles include a link-out icon that takes users to the provider’s website.

Biz2X

About Biz2X

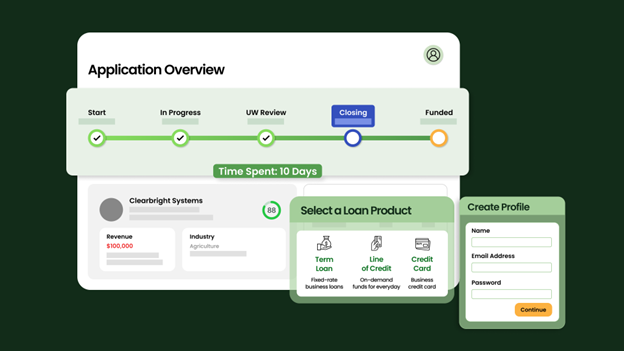

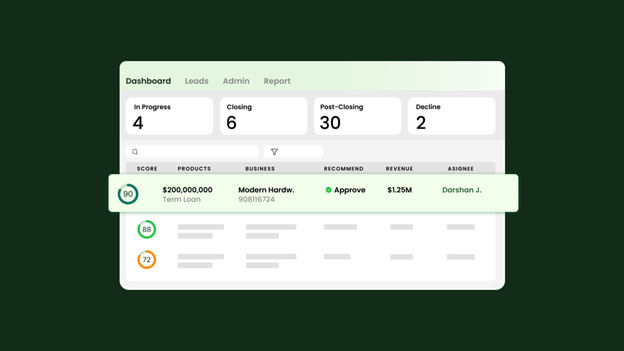

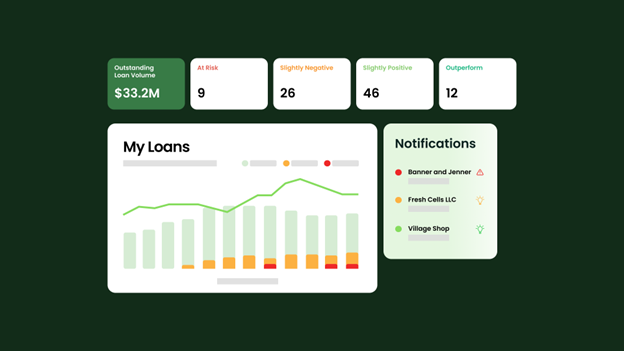

Biz2X is a loan origination platform that equips your financial institution with flexible cloud technology to automate and modernize their lending operations. Biz2X delivers a configurable, low-code solution that adapts to each institution’s unique credit policies and workflows. The platform enables banks to increase productivity, improve the borrower experience, and scale their lending programs efficiently.

We enable banks to do more with less – faster loan decisions, better borrower experiences, and strong credit assessment.

• Seamless borrower experience – Fully configurable loan application journey to match an institution’s brand, loan type and workflows—that works across any device.

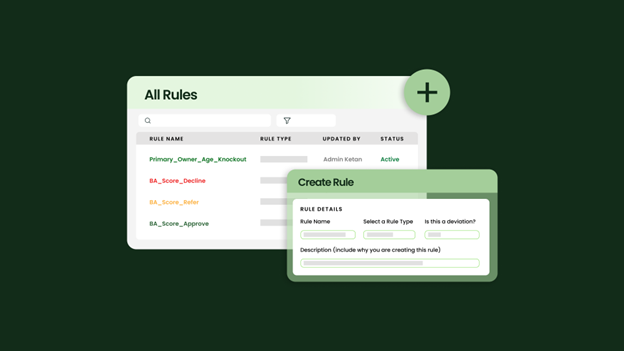

• Configuration flexibility – Our fully configurable platform works for all banks by enabling customization specific to their branding. Biz2X matches your credit policies, giving precise control over configurable decision rules.

• Credit analytics tool suite – Banks can control risk and accelerate automated loan decisions by combining powerful third-party data integrations, credit analysis tools, and transaction-level reports.

• An established lending ecosystem - Biz2X loan origination software comes with pre-built integrations and leading technology partners to reduce manual entry and enhance platform capabilities.

Biz2X pricing

Biz2X does not have a free version.

Starting Price:

Not provided by vendor

Show more details

Free Version:

No

Free trial:

No