LendingPad is a cloud-based mortgage loan origination system (LOS) that helps businesses streamline and manage loan...

Software Advice offers objective, independent research and verified user reviews. We may earn a referral fee when you visit a vendor through our links.

Learn more

Our commitment

Independent research methodology

Software Advice’s researchers use a mix of verified reviews, independent research and objective methodologies to bring you selection and ranking information you can trust. While we may earn a referral fee when you visit a provider through our links or speak to an advisor, this has no influence on our research or methodology.

How Software Advice verifies reviews

Software Advice carefully verified over 2.5 million+ reviews to bring you authentic software and services experiences from real users. Our human moderators verify that reviewers are real people and that reviews are authentic. They use leading tech to analyze text quality and to detect plagiarism and generative AI.

How Software Advice ensures transparency

Software Advice lists all providers across its website—not just those that pay us—so that users can make informed purchase decisions. Software Advice is free for users. Software and service providers pay us for sponsored profiles to receive web traffic and sales opportunities. Sponsored profiles include a link-out icon that takes users to the provider’s website.

Business Financing Solution

About Business Financing Solution

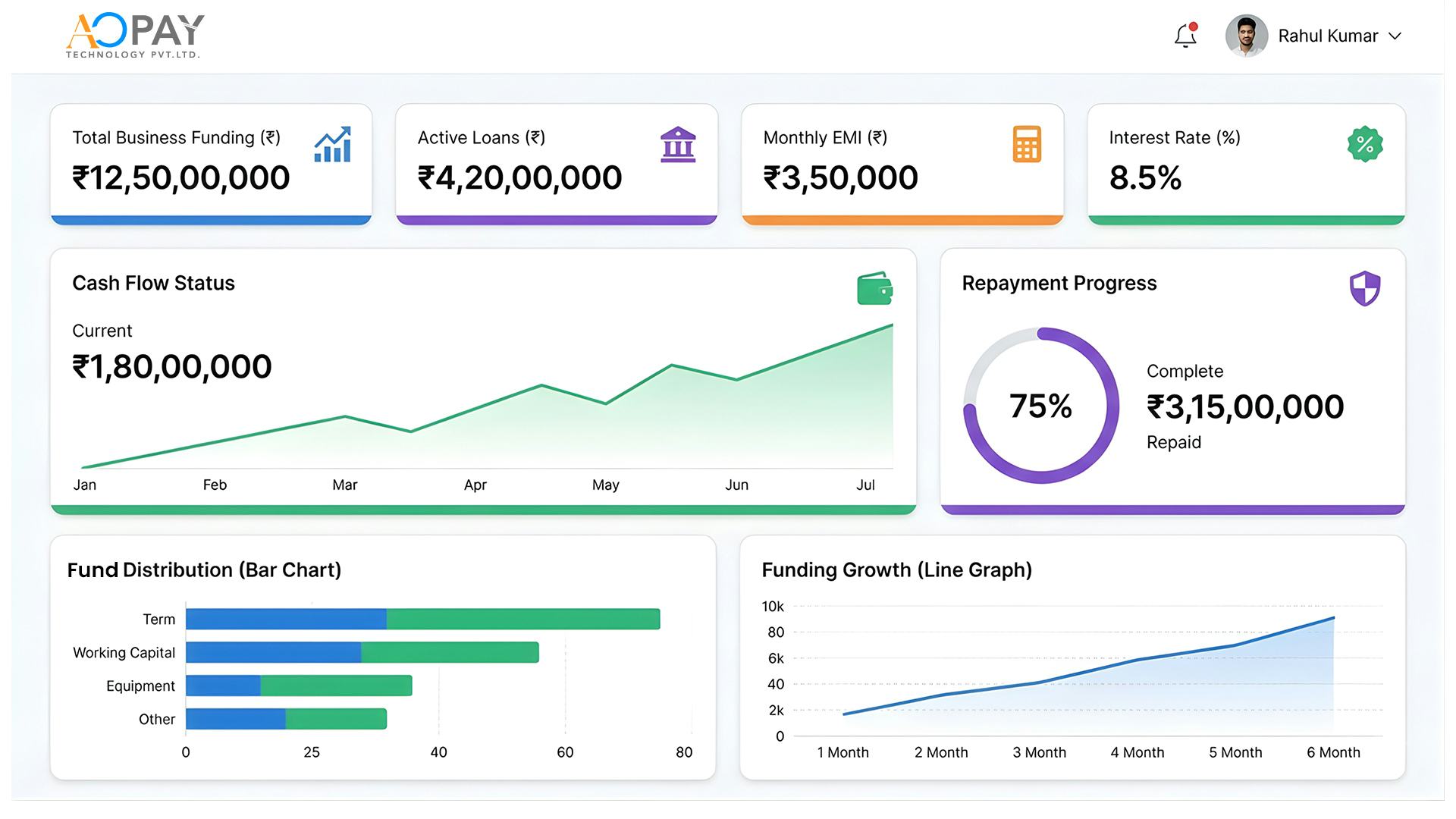

AOPAY Best Business Lending / Loan Software Solution is an enterprise-ready platform designed to help lenders manage business loan operations efficiently while maintaining compliance and control. Suitable for banks, NBFCs, and fintech companies, our software supports modern digital lending models and high-volume loan processing. AOPAY solution automates key processes including borrower onboarding, KYC verification, credit evaluation, loan origination, underwriting, approvals, disbursement, repayment collection, and loan closure. Configurable workflows allow lenders to customize loan products, interest rates, repayment terms, and risk policies based on business needs.

With built-in integrations to credit bureaus, core banking systems, accounting software, and payment gateways, Business Lending Software enables faster decision-making and seamless data exchange. This reduces turnaround time and improves operational accuracy. Compliance management is simplified through audit trails, document management, consent tracking, and regulatory reporting. Real-time dashboards provide insights into portfolio performance, delinquency rates, cash flow, and risk exposure, supporting informed lending decisions.

Designed to scale, AOPAY software supports multiple business loan products such as SME loans, working capital financing, term loans, and equipment loans. Its secure and flexible architecture allows organizations to grow loan volumes, expand product offerings, and onboard new borrowers efficiently. By automating lending operations and centralizing data, Business Lending Solution helps organizations reduce manual workload, control risk, improve profitability, and deliver a better borrower experience through faster approvals and transparent servicing.

Business Financing Solution pricing

Business Financing Solution does not have a free version and does not offer a free trial.

Starting Price:

Not provided by vendor

Show more details

Free Version:

No

Free trial:

No